The function of the Customs authorities in protecting and enforcing the Intellectual Property has often been overlooked. Most people are unaware of the scale at which the enforcement of intellectual property rights is done by the Customs authorities. Customs are therefore at the vanguard, protecting the citizenry from harms that may adversely impact not only their finances but their health as well.

The Indian laws have given plenty of powers to the Customs authorities to tackle the plague of counterfeit, pirated, and smuggled goods into India. Both the Customs Act, 1962 as well as the Intellectual Property Rights (Imported Goods) Enforcement Rules, 2007 contains provisions barring the entry of infringing goods in India, but their strong enforcement is still a faraway thought given the lack of information regarding these remedies among the stakeholders. This article tries to show why strong enforcement of IP is required and the impact that fake and counterfeits can have on the overall business market of the industry.

THE NEED FOR ENFORCEMENT

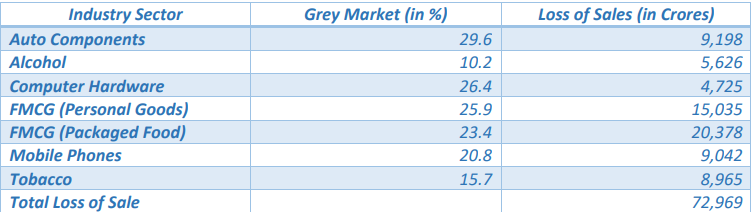

A study conducted by the Federation of Indian Chambers of Commerce and Industry (FICCI) in 2019 has made the shocking revelations that an estimated loss of over 72 thousand crores has been suffered by the industry in India due to counterfeit, smuggled, or pirated goods in the markets, with FMCG (Packaged Food) sector leading the pack. This roughly translates to about 21.7% in lost sales for them in the year 2012

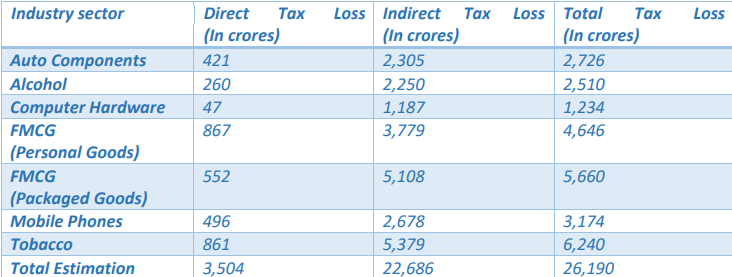

Furthermore, this has caused immense losses to the exchequer in terms of lost tax revenue that the government would have otherwise received. The FICCI report has pegged the estimated annual loss to the government at over 26 thousand crores, with tobacco sectors accounting for the maximum loss of revenue to the exchequer.

THE EXTANT STATUTORY FRAMEWORK FOR ADMINISTRATIVE IP ENFORCEMENT

India has a total of 224 ports as of 2020. These ports see large volumes of trade pass through them. This necessitates strong laws to tackle the bulk of counterfeits that may enter via these ports. The two main laws that aid the Customs authorities in successfully enforcing IP rights at the borders are the Customs Act, 1962 and the Intellectual Property Right (Imported Goods) Enforcement Rules, 2007. Both these laws work in tandem to achieve the successful enforcement of IP rights. Therefore, provisions from both these laws must be looked at to have a holistic picture of the legal enforcement of IP in India.

The Customs Act, 1962 is a general law that contains specific provisions pertaining to the enforcement of IP rights at Indian borders. The Customs Act allows the Central government to proscribe the export or import of goods of any specified description, either absolutely or conditionally, by notifying them in the Official Gazette. Notable purposes4 apropos to the present discussion, for which notifications can be issued are:

- the prevention of smuggling

- the protection of patents, trademarks and copyrights;

- the prevention of deceptive practices

- the implementation of any treaty, agreements or convention with any country

- the prevention of the contravention of any law for the time being in force; and

- any other purpose conducive to the interests of the general public

The above list is indicative of the wide scope that exists under the Customs Act. In addition to having a specific head for patents, trademarks, and copyrights, the powers are wide enough to prevent other forms of intellectual property rights from being misused as well.

The Intellectual Property Rights (Imported Goods) Enforcement Rules, 2007 are specific rules that have been notified5 under the Customs Act, 1962. These rules elaborate on the procedure that is to be adopted by the owners of intellectual property (called Rights Holder) to get their notice registered with the Customs authorities. This is called Custom recordal. The Commissioner is required to notify the rights holder of the registration or rejection of their notice within 30 days. Once registered, this notice stays in force for a minimum of one year unless the rightsholder requests for a shorter time. The Central government then issues a circular to all the customs offices opted for by the rights holder with instructions and details on the intellectual property needed to be enforced.

The scope of the abovementioned rules has been curtailed with the 2018 Amendment that has excluded patents from the list of IPR that can be enforced at the customs through the recordal process. The amendment has to be seen as a welcome move on part of the legislature given the technical nature of the Patents. It cannot be expected from the bureaucrats, trained in the general administration, to understand the highly complex patents. However, the power to issue notifications with regards to patents is already available to the authorities under the Customs Act, 1962. Thus, the effectiveness of the 2018 amendment is still to be judged with the Customs Act, 1962 intact with earlier provisions.

PROCESS FOR SUSPENSION AND CONFISCATION OF GOODS

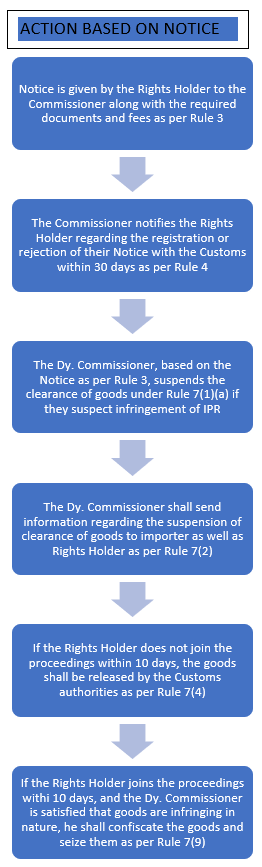

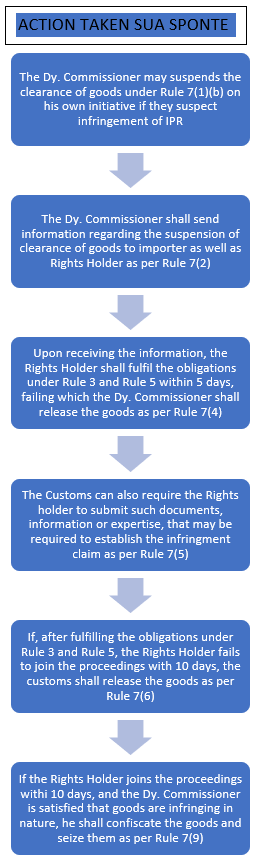

The process by which the goods get suspended and ultimately confiscated by the Customs authorities is two-pronged. As has been made clear from the discussion above, one way of getting the clearance of infringing suspended is by registering the notice with the Commissioner. But the customs authorities can suspend clearance sua sponte as well. The Process followed by the customs authorities in both the situation has been elaborated as under:

PROCESS FOR REGISTRATION OF NOTICE

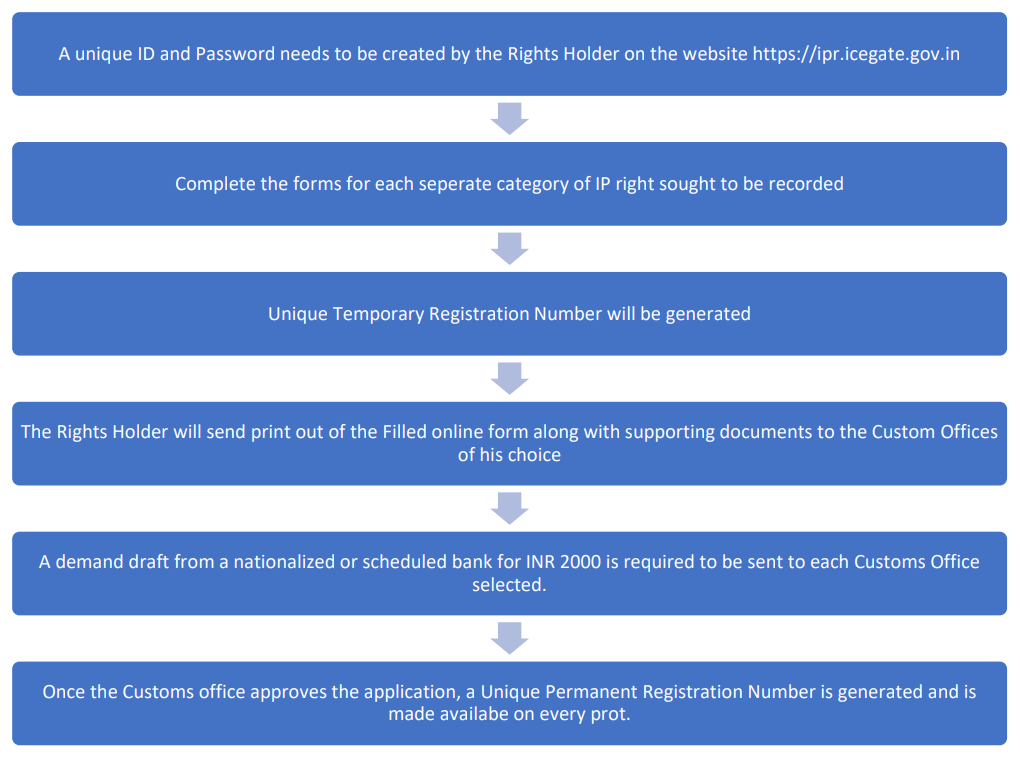

The process of registering the notice with the Commissioner of Customs has been simplified by the government considering how important it is for the economy. A dedicated website, “ICEGATE” has been developed through which the Rights holder can register their notice and submit the requisite fees as well. The step by step procedure has been laid down in detail:

The documents required to be submitted at the time of registration with ICEGATE are following:

Proof of ownership of the Intellectual Property Right

- Scanned copy of the Certificate of Registration

- Serial Number of the Demand Draft made out in favour of Commissioner of

Customs - Scanned copy of Power of Attorney in favour of the Advocate/Counsel/Agent

- Statement of exclusivity outlining the scope of IP right that is to be recorded

- Specimen of Original goods (in case of trademarks and designs)

- Grounds for suspension of infringing goods

- Images for infringing goods

- Differentiating features of Original and Infringing goods

- IEC code of the Rights Holder

- Customs Tariff Heading of applicable goods

- General Bond or Centralised bond

It is important here to note that in case of a Rights holder having registration of Trademark in different classes, his registration for each class will be treated as a separate application by the Customs authorities and fees shall be paid for each of the classes. However, a multiclass Trademark registration is treated as a single application across classes.

The Requirement to execute a bond under the rules is put in place to protect the customs authorities, importer of goods, consignee, and owner of goods against all the liabilities that may occur as well as to meet the costs such as destruction, demurrage, and detention charges. As per the government mandate, the value of the bond that needs to be executed by the Rightsholder shall be equal to 110% of the value of goods that are seized by the Customs authorities. The amount to be deposited with the customs, however, is only 25% of the total bond value and

the rest of the amount shall be deposited as and when any liability arises in due time.

IMPACT OF IP ENFORCEMENT IN INDIA

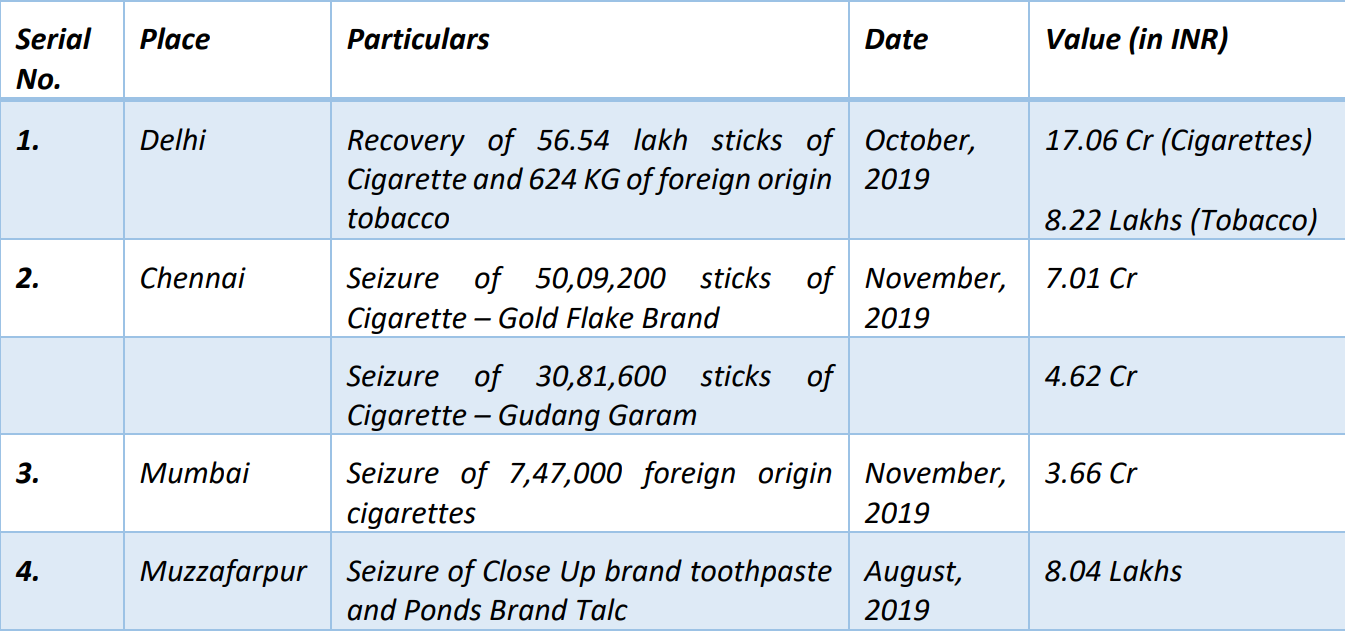

The remedy of IP enforcement is still in its nascent stages, with most of the actions taken by the Customs authorities on ex-officio grounds. But the impact that this has had on IP protection cannot be said to be negligible. The government has been vigilantly undertaking the issue of IP infringement and has been instrumental in taking down the culprits. During the past years, the authorities have undertaken several enforcement actions that are proof of their capabilities in accomplishing results. A snapshot of the enforcement work that the authorities have been

doing in the recent past has been tabulated below.

The above is only an indicative list of the enforcement work that has been done by the authorities. It shall be used as a precursor by the Rights Holder in various places and situations as to the impact that such successful enforcement can have on their brand names as well as revenues. It should be made an important part of the intellectual property enforcement strategy that is being developed by various brands across the country and the globe. The enforcement of IP at the customs level is very embryonic and its under-utilization can be proved by the fact that out of 448 instances that India appeared in IP-related infringement reports, only 1 was reported. Better utilization of this tool is destined to be a game-changing element, not just for brands in India but internationally as well.

SOURCES

- “Socio-Economic Impact of Counterfeiting, Smuggling and Tax Evasion in Seven Key Indian Industry Sectors”,

FICCI (2012), available at: http://www.ficci.com/spdocument/20190/anti-smug- ficci-study.pdf - https://www.statista.com/statistics/686447/india-total-number-of-ports/

- Government Notification o. 47/2007-Cus. (N.T.), dated 8-5-2007

- World Trade Report, 2019